UN Climate Talks

Climate change continues to make media headlines as we await the outcome of the next round of UN global climate change talks (COP21) in Paris this December. The goal of these negotiations is to achieve a legally binding global agreement on greenhouse gas emissions. Based on advance commitments from the US, China, Europe and India, we will inevitably see governments implementing stricter emissions targets. While a global carbon tax is still a way off, additional regulation to reduce greenhouse gas emissions poses a systemic climate risk to investment portfolios. As every challenge is also an opportunity this coming regulation creates substantial investment options in climate change solutions.

New Disruptive Technologies

The emergence of numerous clean energy technologies is accelerating and moving to mainstream, unsubsidised markets as their costs continue to fall rapidly. For example, global solar installations have skyrocketed as prices have dropped by more than 75% in recent years. Lithium ion batteries for storing electricity and LED lighting which uses significantly less electricity are also developing quickly and gaining wider adoption. These cleaner and more energy efficient technologies are posing a real economic threat to the traditional energy sector and present many compelling investment opportunities globally.

Stranded Fossil Assets

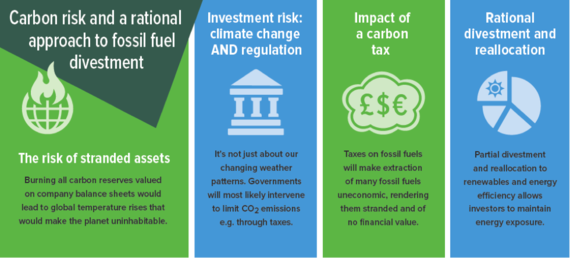

The burning of fossil fuels is of course the main contributor to greenhouse gas emissions. If we are to limit global warming to maintain a habitable planet, many of the fuel reserves currently on the balance sheets of fossil fuel companies will have to stay in the ground--effectively rendering them worthless or stranded. Fossil fuel companies with relatively higher extraction costs are likely to see their market valuations significantly eroded.

Source: Impax Asset Management

So what does this mean for investors?

Many investors remain wary of "missing out" from the dividends from fossil fuel stocks. But they should also think about capital preservation. In spite of a relatively high dividend payment, such stocks can lose market value quickly; over the past 3 years, the share prices leading coal companies have fallen 90% or more with several bankruptcies.

In contrast, there are approximately 200 stocks with an aggregate value of nearly $1 trillion operating in the low carbon energy efficiency sector. This high tech, diverse sector is forecast to grow more rapidly than the economy. By investing in energy efficiency companies across industrial, transportation and building markets, investors can effectively maintain their exposure to the energy sector, while benefitting from the increase in energy prices that a carbon tax will produce. Wise investors will take the opportunity to invest in low carbon energy before everyone else figures this out.