After a long delay and plenty of resistance from corporations, the Securities and Exchange Commission approved in a 3-to-2 vote last Wednesday a rule that would require most public companies to regularly reveal the ratio of the chief executive's pay to that of the average employee.

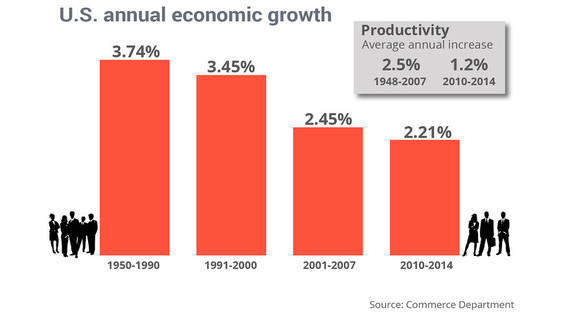

This may help us to understand why there has been so much talk of a new, slower "normal" of economic growth, now averaging slightly more than 2 percent during recovery from the Great Recession? Because we are finding out much of the slower growth is due to a misallocation of resources. That is, the huge profits generated within most industries are no longer being put to good use.

Economic growth is determined in large part by productivity, or output per worker hours, and population growth. But other less growth-friendly policies have also affected growth. Both population and productivity growth have been less than stellar since 2000. Marketwatch columnist Jeff Bartash is one who blames it on the drop in domestic investment in plants and equipment, combined with slower population growth.

The big productivity slowdown began in 2001, as the Marketwatch graph portrays. And that was when the federal deficit ballooned. We paid for two wars plus two recessions with massive borrowing, while enacting massive tax cuts that sharply reduced government revenues. And we will continue to pay for those deficits, as more money has to be borrowed to pay for the consequent deficit spending that occurred, since revenues as a percentage of the federal budget haven't returned to pre-2000 levels.

The result has put the advocates of austerity policies in power, both here and in the eurozone. Instead of investing in the future, they have pushed to pay down the debt by cutting government spending, rather than investing in what will increase future growth and so revenues to pay down that debt.

Let's not forget that Europe went through the same Great Recession, due in large part to its own busted housing bubble and easy money policies when the single-currency Eurozone was introduced. But they never learned from their own mistakes.

In Europe it is the Germans and other E. European countries advocating more austerity, which means paying off debt takes precedence over future growth. They fear inflation, above all, when there is none. So they have been experiencing nothing but deflation and multiple recessions since 2008.

In the U.S., it is the rise of extreme conservative and racist politics by the Tea Party, and southern anti-government conservatives that continue to fight the civil war. They still see big government as the anti-slavery north bullying poor southerners.

But that has nothing to do with the real problem, which is slower growth. In fact, the diversion of profits to the top 1 percent -- and loss of incomes for all the rest -- may be the real reason for such reduced productivity. Productivity levels pre-2000 used to double the standard of living every generation.

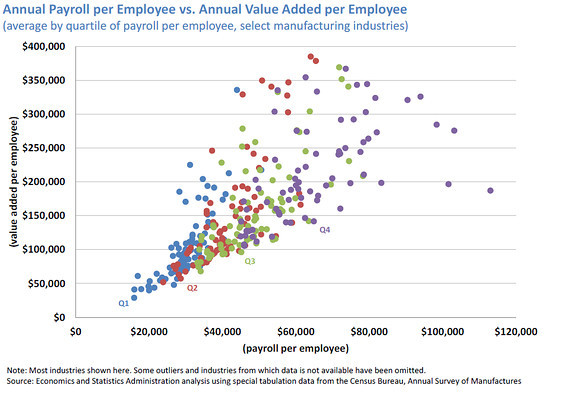

A new study by the Commerce Department highlights the damage done to productivity by reducing the income of the middle class, in particular. "Research suggests that firms with higher payroll per employee have more skilled workers who also work harder, and the companies adopt other practices to take advantage of this talented, dedicated workforce and further boost its productivity," says the study.

The top quartile of each industry is represented by a purple dot, with lower quartiles in green, red, and blue.

Three factors generate this higher productivity, says Commerce:

- First, paying higher wages allows firms to attract workers with more and better skills.

- Second, firms that pay their employees more are effectively able to "buy" increased morale, lower turnover, and higher productivity from employees who are committed to keeping a good job.

- Third, high-road firms adopt other practices that increase the return to having skilled and motivated workers. One example is the greater capital intensity of high-wage firms mentioned above.

Isn't this self-evident? So why do American CEOs -- highest paid in the world -- tolerate such below grade productivity in their industries? This isn't one we can blame on government inefficiency. The private sector doesn't seem to be aware of what is in their own best interests.

Maybe because corporations now have to publish CEO-employee pay ratios will shine more light on the misallocation of incomes and investment, in particular.

Follow Harlan Green on Twitter: https://twitter.com/HarlanGreen