This post is co-authored by Michael Groeneman

Let's start with a story.

Imagine that you're a small writing business. In one month, you have one writer do one writing job for one customer. At the beginning of the month, you have nothing. Your bank accounts are as empty as your pockets. Nothing owned or owed.

Your first customer accepts one writing job for $50, and you agree to pay the writer half of it. At this point, do you know how much cash and revenue you've made? (Answer: $0 and $50). Now the check from your customer clears and you give $25 in cash to the writer. Have revenue or cash changed? (Answer: Yes and no, now you have $25 in cash but revenue is still $50).

Let's make it a little more interesting. During the month, you rent an office for $5, and buy $5 of scented candles. Impressed by your cinnamon-smelling office and first sale, an investor buys $100 of stock in your business. At the end of this month, what are your retained earnings? (Answer: $15, because you now have $115 in cash and sold $100 of equity in your company).

Every entrepreneur, at some point, should learn basic accounting and know these answers.

When you first start a business, it's easy. You make a website, you market it, and then you wait. You might eventually put up advertising or start charging visitors to use your website. The checks clear, the credit cards settle, and then you have cash. You buy stuff for your business, and then you have expenses. In the case of normal mom and pop corner shops, you watch cash closely so there's always enough to cover expenses. Around Silicon Valley, unprofitability is the name of the game, but let's ignore that for now.

The thing you need to understand is exactly what "revenue" means. It's a word that gets tossed around a lot, but for accountants, it has a very specific definition. Revenue can only be reported when it is earned. Earned means a buyer accepted your service or product, and you've invoiced for it. If you invoice or collect payment in advance of delivery, that's called "deferred revenue," but we'll save that for another article.

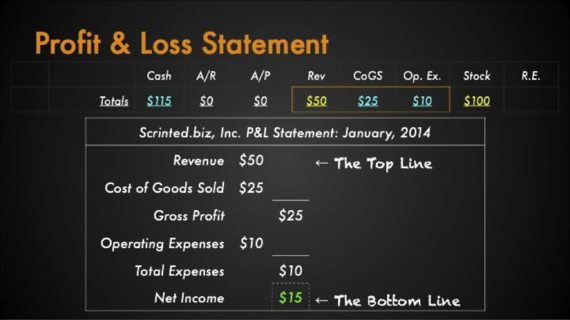

Now that you have investors, they'll want a report on what happened in the first month, and they'll want to look at your finances through a few different lenses. First is the obvious: what did you sell, what did it cost to make, and how much was your profit? That's your basic Profit & Loss Statement (or what the cool kids call "the P and L").

In your P&L this month, you made $50 in revenue (the top line), but it cost $25 to produce it (that's your Cost of Goods Sold, or COGS), and after your $10 in operating expenses (cheap rent and expensive candles), you ended the month in the plus column with $15 profit (the bottom line). Good job!

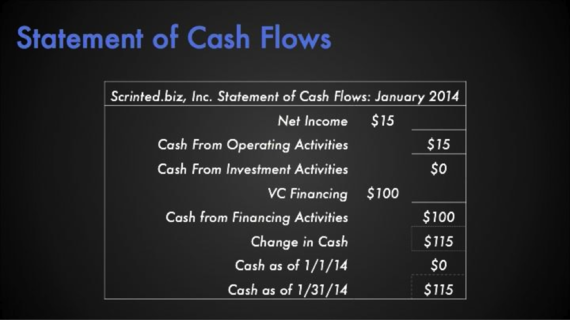

However, the goods you sold aren't always equal to the cash you collected. Sometimes people don't pay you right away. Savvy investors know this, so they'll want to look specifically at cash. This is called the Statement of Cash Flows. The Statement of Cash Flows always starts with Net Income and fixes that number to account for cash. In this example, it was all roses. You actually collected your revenue, so the profit from the P&L was all cash, and you got $100 in investment, also in cash. You started with nothing and end the month with $115 in cash. Business is great!

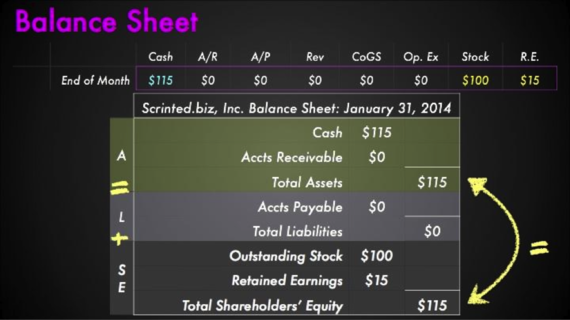

Finally, they'll want a summary of all of your accounts: what's in cash, what's owed, how much is owed to you, how much stock has been purchased. That's called the Balance Sheet. You might have figured out already that your only asset is the $115 in cash, and that cash was created by selling $100 in equity and making $15 in profit. We call it a Balance Sheet because this equation, Assets = Liabilities + Shareholder Equity, must always stay true. It's always balanced. We won't explain why this is, but $115 in cash goes in the assets column, and your $100 investment plus $15 in retained earnings (profit) goes in the equity column. So the sides are balanced.

Let's try to briefly pull this all together by showing the general ledger below. Across the top, you'll see specific accounts in their general category (asset, liability, or equity). Accounts always fall into one of these three categories.

The box outlines in the ledger below represent the detail for two of our three financial reports. The orange box with the totals from revenue, COGS, and expenses, is our P&L. The balances at the bottom in the pink box go onto our balance sheet. Our Statement of Cash Flows can't easily be grouped by a box in the ledger, and that's why it is the Achilles heel of most MBA finance students.