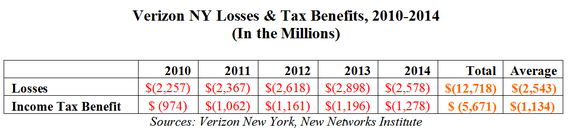

*(NOTE: This five-year period is based on 2010-2014; Verizon NY's 2015 financial information is not available yet.)

Yes, it is tax season yet again and you probably paid more taxes than Verizon NY. (NOTE: Verizon's other incumbent phone companies are using the same 'questionable' financial book keeping, but their accounting is not public.)

Based on the Verizon NY annual reports, the losses are staggering, and there has been no public outcry, even though these losses were used to raise rates multiple times.

Isn't Verizon's FiOS profitable? How about Verizon Wireless?

In just 2014, Verizon NY lost $2.6 billion and had an 'income tax benefit' of $1.3 billion.

Moreover, Verizon has taken a swipe at Bernie Sanders' presidential campaign for reporting the losses of Verizon overall. Truth be told, for six years, 2008-2013, Verizon paid ½ of 1% in taxes - on income of more than ½ trillion dollars.

Going through the Numbers

- Verizon NY lost $2.6 billion in 2014 and had an "income tax benefit" of $1.3 billion.

- Starting in 2010, Verizon NY showed losses with an average of $2.5 billion a year that resulted in an average 'income tax benefit' of $1.1 billion.

- For this five year period, Verizon NY lost $12.7 billion and had an income tax benefit of $5.7 billion.

- NOTE: 2013 showed a profit from a one-time 'extraordinary' pension deal, but the exact same losses were still being accrued.

- NOTE: These are 'actual' losses as stated in the state-based annual reports. There are other financial books, not to mention the tax returns, which are not public.

Verizon NY Losses Started in 2003

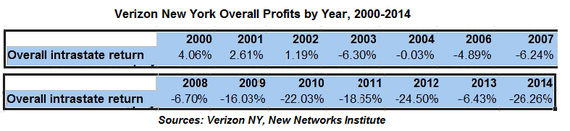

Verizon NY has been losing money and the data shows that there has been a continuous negative number annually, starting in 2003, for 11 years, 2003-2014.

In fact, since 2006, Verizon NY has been able to get multiple rate increases based, in part, on these losses. The other reason for the rate increases -- Verizon was supposed to be spending the rate increases on "massive deployment of fiber optics in New York" (which stopped in most of the NY State post-2010).

June, 2009, the NY State Public Service Commission (NYPSC) wrote:

"We are always concerned about the impacts on ratepayers of any rate increase, especially in times of economic stress,' said Commission Chairman Garry Brown. 'Nevertheless, there are certain increases in Verizon's costs that have to be recognized. This is especially important given the magnitude of the company's capital investment program, including its massive deployment of fiber optics in New York. We encourage Verizon to make appropriate investments in New York, and these minor rate increases will allow those investments to continue'."The rate increases will generate much needed additional short-term revenues as the company faces the dual financial pressures created by competitive access line losses and the significant capital it is committing to its New York network. For 2008, Verizon reported an overall intrastate return of negative 6.7 percent and a return on common equity of negative 48.66 percent."

Verizon will most likely mention all of the other taxes and surcharges it pays -- well, actually you pay.

Verizon, will of course, focus on the other taxes. fees and surcharges, which could include the Universal Service Fund tax, E911 emergency fee, or the NY Municipal Construction Surcharge, and even most of the 'excise taxes'.

In all of these cases, these surcharges may be revenue to the company, such as the "ARC" charge or the "NY Municipal Construction Charge", or even E911, as Verizon, last time I checked, was in charge of these emergency networks in parts of the state. Moreover, the excise taxes can be taxes applied to Verizon, but they get to pass them through to you. Even the Universal Service Fund is a charge as a tax on the company, but it is allowed to 'pass-through' the costs to us.

Here's Verizon's explanation of the fees that may appear on your bills.

- Access Recovery Charge (ARC)

- This monthly Verizon surcharge is applied on a per line basis and is related to the Federal Intercarrier Compensation Rules, which set the rates charged between carriers for telecommunications traffic. (NOTE: This is direct revenue to Verizon.)

- 911 Emergency Service Fee

- This is a fee that Verizon is required or authorized by government agencies to collect from customers. The government agencies use the funds collected to cover the telecommunication costs of providing 911 emergency response. The fee is generally either an amount per telephone access line or a percentage of revenue.

- NOTE: Verizon had the contract for E911 in NYC as of 2015 and other parts of NY. See Audit of New York City's E911 system, released in 2015.

- Federal Universal Service Fund (FUSF) Charge

- This monthly Verizon surcharge allows Verizon and Verizon Long Distance to recover from its customers the funds it pays to the Federal Communications Commission (FCC) on interstate services to support the FCC's universal service programs such as eRate and LifeLine. The FCC regulates this charge; reviewing and adjusting the fee quarterly based on the FCC's quarterly FUSF contribution factor. The FCC uses the fund to help keep local telephone rates affordable for all customers, support telecommunications services in schools, public libraries, and rural health-care facilities and subsidize local service to high-cost areas and low-income customers.

- FiOS Digital Voice (FDV) Administrative Charge

- This monthly line charge helps defray account servicing costs associated with providing Internet Protocol (IP) voice services. This surcharge is applied by Verizon and is not a tax or fee assessed by a government agency.

- NY Municipal Construction Surcharge

- The NY Municipal Construction Surcharge recovers a portion of the expenses Verizon incurs for relocation of its facilities that are in the public rights-of-way to prevent interference with street repairs, public construction projects or other activities required for public health, safety or convenience. The charge is reflected in the Verizon Surcharges and Other Charges & Credits section of the bill."

- State Utility Gross Receipts Tax Surcharge/Telecommunications Services Excise Tax

- Applied per line, this monthly Verizon surcharge recovers from customers the state or local tax on gross revenue paid by Verizon, and may be referred to on your bill as a Gross Receipts Tax Surcharge, a Telecommunications Services Excise Tax Surcharge, or a State Transaction Privilege Tax Surcharge.

Verizon's Overall Tax Payments, 2008-2013: ½ of 1% 'Effective Rate'

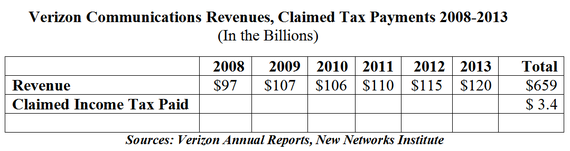

In March, 2016, the Sanders' presidential campaign was taken to task by Verizon, who said that it is one of the largest corporate taxpayers in the nation, and the Verizon spokesman told Politico that between 2008 and 2013 they had paid $3.4 billion in income taxes.

Politco writes:

"VERIZON TIRES OF SANDERS' TAX CLAIMS -- Verizon has had enough of suggestions from Democratic presidential candidate Bernie Sanders that it's not paying proper taxes. 'Verizon is a solid, American company and is among the largest corporate taxpayers and investors in the nation,' said Jim Gerace, the company's top spokesman. 'We take issue with those who falsely claim that we avoid paying our fair share of taxes. This campaign of misinformation and inaccurate data needs to stop'."

"In the run up to the Iowa Caucuses, he said the total federal income taxes paid by major firms Verizon, GE, and Boeing, between 2008 and 2013 added up to less than zero. (A Verizon spokesman said the company paid $3.4 billion in income tax in that timeframe.)"

Checking the Verizon annual reports, then, and using the statement made by Verizon, that the company spent $3.4 billion from 2008 to 2013 - which is six years, that means Verizon paid about $1/2 billion a year on average.

However, Verizon is a large company and its revenues were $659 billion for these years, as told by the annual reports. Verizon, therefore, paid an effective tax rate of 1/2 of 1%. (We didn't even bother to check whether Verizon paid $3.4 billion for those six years.)

Their 2008 annual report showed that the 'effective tax rate' to be applied was 34.1%.

- Percentage of Actual Payments --1/2 of 1%

So, as you sit paying your annual tax bills and your monthly communications bills, including the taxes that are applied on the communications companies that are passed through to you, or all the money already taken out of your paycheck... fill in the blank _____ to express how you feel about this inequitable situation.