Young adults are depositing more to savings accounts and paying down 57% more student loan debt than Gen X or Baby Boomers. Finger is pointing at the Great Recession.

San Francisco, CA, April 17, 2013 -- SaveUp (www.saveup.com), a national online financial rewards program for saving and paying down debt, today announced the findings of its April U.S. Consumer Savings and Debt Report. This month's major findings focus on the trends amongst young adults (22-32 years old) including recent college graduates.

Young adults, a generation scarred by financial turmoil, are demonstrating a fundamental shift in the way Americans approach personal finance. The combination of higher average savings account contributions and lower non-asset building debt indicates that young adults are taking a balanced approach to managing their finances.

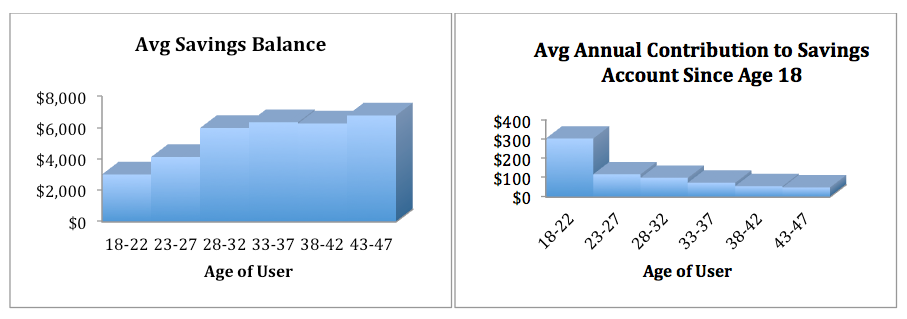

Whilst young adults may be lower wage earners, those who have initiated savings are doing so aggressively in their 20s and early 30s as the data demonstrates below. The average annual savings account contribution reinforces the notion that young adult savers are more aggressive savers.

For young adults, the rate of contributions early in their careers is a promising sign that they are positioning themselves better for retirement than boomers. In a national survey, 27% of respondents aged 55-64 said that they intended to save money when prompted to make a new year's financial resolution, while 54% of respondents aged 18-34 intended to do so.**

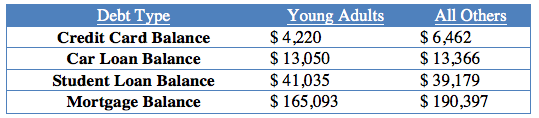

Heavy focus on debt repayment is also an indicator of better financial habits among young adults. Despite having more student loan debt than the average American, young adults are paying down their debt more aggressively. In March, young adults paid off 1.2% of their student loans while others only paid down 0.7% even though young adults only carry an average of 4% more student debt. In March, the average young adult paid down 57% more student loan debt than older generations, $461 versus $294. In other categories of debt, young adults holding debt hold smaller mortgages, likely due to lower earnings.

While young adulthood is traditionally marked by independence, the Great Recession led to a 25.5% rise in young Americans moving in with their parents (between 2007 and 2011).* Living with one's parents precipitates different social behavior than living on one's own, but it also happens to induce a different approach to financial management. Moving back in with mom and dad means delaying home purchases and reducing financial constraints.

Not only did the Great Recession affect young adults' short-term financial goals, but many believe their mindsets will be impacted long term as well. The Great Recession caught Americans by storm, resulting in the loss of employment, underemployment, forced early retirements, and pay cuts for many. While the effects were certainly felt nationwide, data suggests that "the economic downturn can profoundly impact major life decisions and limit choices for people in their 20s and 30s: young Americans have high unemployment, are buying fewer homes, and putting off childbearing."** Scholars believe that this will result in a long-term cultural shift driven by a generation of young adults marred by financial woes, which becomes ever more transparent with data that indicates this is already evident.

"Perhaps the Great Recession was a wake-up call," says Priya Haji, CEO of SaveUp. "Young adults have more to thank than just the Great Recession for their sound financial planning though, as many younger demographics are more likely to use online tools and other financial resources to help them meet their goals. The threat of financial insecurity has instilled a permanent sense of financial awareness with this country's young adults. This new awareness spurs determination, drive, and openness to adopting new world technologies in order to solve old world problems."

Methodology

The SaveUp U.S. Consumer Savings and Debt Report analyzes current savings and debt levels of its user base and will make monthly comparisons pulled at least 30 days prior and no more than 90 days prior to the stated month. This month's report is based on the data of a representative sample of more than 25,000 SaveUp users' savings and debt balances.

About SaveUp

Founded in 2011, San Francisco-based SaveUp is the first free nationwide rewards program that encourages Americans to save money, pay down debt and make positive financial changes. By partnering with major consumer brands and financial institutions, SaveUp gives users the opportunity to win exciting prizes for performing positive financial actions. Individual user information is secure on the site with bank level encryption. Intuit provides the back-end aggregation technology and SaveUp has completed a bank-level security audit.

To get rewarded for your positive financial actions or to partner with SaveUp as a bank or sponsor, please visit us at www.saveup.com

Footnotes:

Non-asset building debt includes loans like credit cards, car loans, lines of credit and other loans.

Taxable investments are any investments of which taxes are not deferred, such as mutual funds, stocks, etc.

Account balances for each type of account mentioned represents the average account balance for participants in the data set who have that particular financial vehicle. Not all participants in the data set have every type of financial vehicle mentioned.

*U.S. News and World Report, 2011, Danielle Kurtzleben

**U.S. News and World Report, 2011, Kimberly Parker