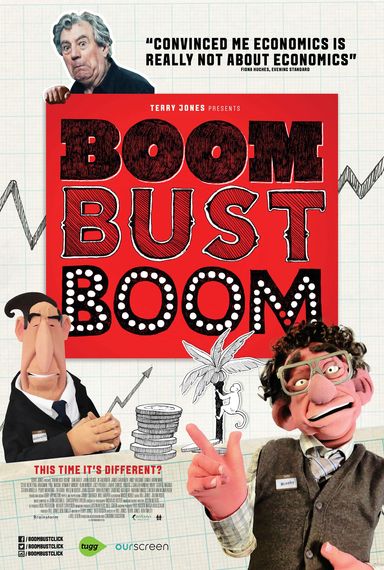

Boom Bust Boom, according to presenter Terry Jones, is all about the "Achilles heel of Capitalism," and how "human nature has driven the economy to crisis time and time again," and if you think it's a bit weird that a former member of the Monty Python troupe should be pontificating on the subject; well, he's one of many reasons for taking a peek at this enlightening/entertaining documentary.

Boom Bust Boom picks up on the notion that financial crashes like 2008 - the result of an overheated housing market -- are nothing new and to prove it the film takes you on an excursion to 17th century Holland. Just substitute "tulips" for "sub-prime mortgages" and you'll find yourself in the midst of a mania brought on by the importation of these beautiful bulbs. Folks went absolutely bananas and those with disposable guilders began investing like there was no tomorrow; after all, it was a guaranteed get-rich-quick investment until, like sub-prime mortgages, it wasn't. In 1637 the Tulip bubble burst.

In similar speculative fashion a cash starved government in early 18th century England backed the creation of the South Seas Company; an effort to sell shares based on trade with South America. There was, however, a bit of a problem. England and Spain were at war and, worse, Spain had a lock on any commercial ventures involving the distant continent. There was a tentative deal of sorts negotiated during a lull in the fighting but the numbers never added up. In the end the only folks who benefited, per usual, were those already in one the scheme/scam (which included members of government). By 1720, the South Seas Bubble, as it was known, burst the already fragile English economy.

Sir Isaac Newton was one of those ruined, as the film points out, losing the equivalent of 2.4 billion pounds, upon which he famously remarked: "I calculate the movement of stars but not the madness of men"

Which begs the question: why would rational folks make totally irrational decisions when it comes to money? "Exceptionalism," according to Stephen Kinsella, a University of Limerick economics lecturer; the pitch for any new investment opportunity is couched in come-on terms: "absolutely one of a kind," "can't go wrong," "get in while you can," and whether it's tulips or mortgage backed securities the effect is to cloud the judgement and glaze the eyes of perfectly ordinary, rational human beings. According to the late, great economist, John Kenneth Galbraith (who appears in puppet's guise) this temporary insanity stems from "an inordinate desire to get rich quickly with the minimum of physical effort."

Wouldn't behavior like this - the sort that befuddled Sir Isaac Newton -- be something taken into account by modern economic theories?

According to Boom Bust Boom: No (emphatically)

Boom Bust Boom points out that a so-called "neo-classical" model has held sway with mainstream economists and this theory posits that a) People are rational when it comes to money and, b) In Capitalist society the economy will always find itself in an equilibrium where bubbles simply can't happen.

It's fallacious thinking, according to the heavyweights interviewed for the film, and they include a trio of Nobel Prize winners: Daniel Kahneman, Robert J Schiller and Paul Krugman, among others.

Prior to the crash Wall Street was popping champagne corks as "exceptional" returns generated by investments in the housing sector kept rolling in, stoked by a chicken-in-every pot sensibility: everyone and anyone who wanted a home got one. Fed head Alan Greenspan spouted buoyant optimism about the future as we raced towards 2008. Then, overnight, Greenspan's financial world - like Isaac Newton's before him - totally collapsed. There were "flaws" in the free-market model, he contritely confessed to a Congressional committee investigating the bust. His faith appeared shaken (for the moment), but not stirred (Krugman points out that Greenspan quickly got back on his free-market horse).

Economics used to be called the "dismal science;" a 19th century term derived from TR Malthus' forecast that humanity is doomed; the population would always grow faster than the food supply. But there's nothing dismal about Boom Bust Boom's presentation of a normally sleep inducing subject. There's Terry Jones narrating, wrapped up in Monty Python style graphics, accompanied by a bunch of Sesame Street style puppets providing additional commentary. Some predictably manic South Park segments and a memorable clip from Life of Brian are thrown in for good comedic measure. My only gripe is that a few minutes could have been shaved off the 70-minute running time without sacrificing any of the impact.

If there's a hero in this tale it's Hyman Minsky, a largely forgotten "I told you so" economist. Minsky had predicted that boom and bust cycles were inevitable in Capitalist society formulating his "financial Instability hypothesis" way back in the 1960's. Economic stability, according to the theory, has within it the potential for creating havoc; when people feel comfortable and optimistic about the future they're prone to take risks in a quest for increased returns on investment -- think debt -- and this mass euphoria can have catastrophic financial consequences. Playing Paul Revere at a time when America was doing quite well got Minsky exiled to academic Coventry by the mainstream economics establishment. It was only in 2008, twelve years after his death, that interest in his theories was rekindled and economists began a mad scramble through remainder and clearance bins in search of his out-of-print tome, Stabilizing an Unstable Society.

So what's to be done?

Boom Bust Boom finds a group of economics students at the University of Manchester who've formed a "Post-Crash Economics Society" to encourage a re-writing of the economics curriculum to make sure that Minsky isn't forgotten. Given the intransigence of the economics establishment they see this as a tough road to hoe.

In 2002 my company, Pacific Street Films, created educational programming aimed at teaching economic fundamentals to High School and University students. There was no talk of Minsky, crashes, bubbles or booms. It appears that we were trying to teach economics in a vacuum, divorced from real-world concerns. One of the students in the Manchester group made a statement that was particularly resonant in this context: "I go home and people ask, so you do economics, so what happened in 2008? I can't tell them..."

If you're one of the many millions who've seen The Big Short and still trying to make sense of what went down in 2008, Boom Bust Boom will provide valuable insights.

It's set to premiere in limited theatrical release on March 11th, then available via On-Demand and iTunes.

Joel Sucher is a writer/producer with Pacific Street Films and has written on a variety of subjects for American Banker, In These Times and Huffington Post. Currently he's working on a memoir, My Goldman Problem, for publication later this year.