Here's a new one: "nichification" in classified advertisements.

As if they weren't already categorized into assorted and sundry. Except now they're more than the print variety to which so many of us have grown accustomed.

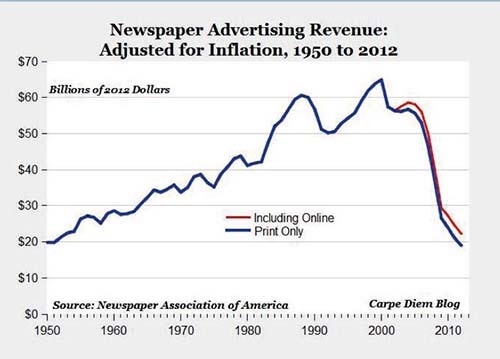

"Once a mainstay of newspaper ad revenue (especially in the USA), printed classified advertisements have shrunk to a shadow of their former importance, paralleled by the explosive growth of classifieds on the Internet," according to a report by industry insiders.

The market is growing exponentially and the permutations are endless.

UK-based Friday Ads, for example, has mushroomed into online niche areas targeting recruitment, hobbies and lifestyle (itself diversified into pets, boating, and snowboarding).

The one-time print monopoly on classifieds has veered into the increasingly mobile ecosystem, which expert Peter M. Zollman defined as mobile access, mobile advertising, and mobile ad placement.

Other factors affecting classifieds are global economic trends, the growth of multimedia, brand internationalization, personalization and socialization, video clips, fraud and abuse prevention, and, "freemium" (the marriage of free and paid premium content).

"Fraud and abuse prevention are critical issues for classified sites," the report said. "While newspaper (print) classifieds were only rarely linked to frauds and abuses, rip-offs, assaults and even murders have been tied in some way to online classifieds."

The data are packed into "Classifieds: Completely different from the old days," a useful guide to understanding the industry's evolution. It is produced by the World Association of Newspapers and News Publishers (WAN-IFRA).

The report is written by the AIM Group (formally, the Advanced Interactive Media Group LLC), a leading consultancy in interactive media and classified advertising.

AIM Group defines classifieds broadly, in the categories of automotive (cars/trucks/other transportation like boats); homes (new homes, resale homes, apartments/flats, condominiums and the like); jobs, and "stuff."

Stuff is typically, but not always, consumer-to-consumer sales of used goods, but can include sales of merchandise by small merchants, it said.

The authors also count social-recommendation engines; service directories (plumbers, roofers, accountants, mechanics); professional networking (LinkedIn, Orkut), and similar online tools.

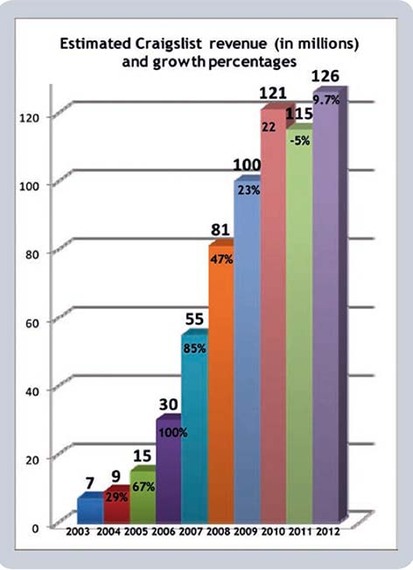

The report examines what impact then upstart US-based Craiglist, the free general merchandise ad site, and international copycats it sprouted have had on millions of buyers and sellers worldwide by catering to their needs, consumption habits, behavior patterns and evolving communication tools.

Across the US border, Canadian competitor Kijiji, an eBay Classifieds division, seems to have a grip on that domestic market, the report said.

Market giant eBay Classifieds also operates portal Gumtree in the UK, Poland, Australia, South Africa, Ireland, Singapore and New Zealand.

"eBay also offers classifieds under the brands Ala Maula in Latin America; Bilbasen.com and DBA.dk in Denmark; eBay Classifieds in the USA, Germany and Italy; Loquo in Spain; Marktplaats in the Netherlands and Mobile.de (autos) in Germany," the report said.

Another case study is of Oslo-based Schibsted, which it said had evolved from a Scandinavian newspaper and media house into a global digital classified powerhouse of 43 brands in less than 15 years.

The company apparently began focusing on classifieds in 1998 and its far-sighted management jumped on the Internet bandwagon, which managers could tell would become a game-changer from the 1990s.

Two geographical surveys of Latin America and India, respectively, zero in on the explosive growth of classifieds that has attracted global giants and countries that are still huge untapped markets.

What I didn't see in the report is any reference to the Middle East/North Africa (MENA) region that is experiencing growth in online advertising.

According to the pan-Arab daily Al Hayat, online adspend in the MENA states stands at $300 million, increasing at a rate of 37 percent annually and is slated to reach the $1 billion mark by 2017.

It quoted Omar Christidis, founder of ArabNet, the hub for Arab digital professionals and entrepreneurs, as saying rising advertising budgets lead to digital prosperity, notably since online advertising is a key engine of growth on the Arab Internet front.

The paper did not specify how much of Arab advertising expenditures went into classifieds, but said Lebanon topped the list at $463 million, followed by Jordan at $140 million.

A major market for classifieds is automotive advertising, which is reaching buyers and sellers via the growing use of "mobile/social."

"Mobile/social" is the key trend in automotive advertising, said the report, noting that growth of use on mobile devices is exploding with users taking advantage of social media to share information and find listings.

"AutoTrader.com in the USA, for example, generates more than 5 percent of its traffic on Facebook. Not 'through' Facebook, on Facebook," the guide said.

Facebook users can search for cars, find recommendations and more from AutoTrader.com on the Facebook site without ever going directly to AutoTrader.com.