Today's jobs report is pretty strong, just as strong as that September 2012 jobs report that still has conservatives in a conspiratorial tizzy. But it is still not strong enough to mean a dramatic improvement in the labor market.

Don't get me wrong: There's not much reason to grumble about 203,000 new nonfarm payroll jobs in November, on top of 200,000 in October, and the unemployment rate tumbling to 7 percent from 7.3 percent -- a five-year low and the biggest drop since that infamous Sept. 2012 report.

But the pace of job growth appears to have settled into a dispiritingly low cruising altitude, more than four years after the end of the Great Recession. It's why the Federal Reserve might not be in any hurry to "taper" its program to buy bonds to stimulate the economy, a program known as quantitative easing.

Payrolls were up just 1.7 percent from a year ago in November -- a fairly anemic growth rate, relative to past recoveries, and it has been stubbornly anemic for much of this recovery. You can see that in the chart below. Even the fairly lousy recovery from the 2001 recession managed to top 2 percent, if only briefly. (Story continues after chart, courtesy of the St. Louis Fed, which hasn't yet updated its data to include November.)

Monthly job growth peaked near or above 5 percent in the 1970s and 1980s, and it held at about 2.5 percent for much of the late 1990s. It has been nearly 14 years since we saw job growth like that.

There are a lot of reasons for the weak job market this time around, including the nature of the recession, which forced banks and households to spend years cleaning up their balance sheets, keeping demand depressed. There are longer-term structural problems, too, affecting both of the past two recoveries, including the replacement of workers by robots and cheaper overseas labor.

Still, much of this pain is self-inflicted. While the Fed has been trying to stimulate the economy, government austerity -- including the sharpest cutback in spending since the end of the Vietnam War -- has played a huge role in keeping growth slow and the job market weak. In fact, it is something of a testament to the resilience of the economy that it has managed to keep growing, however sluggishly, despite repeated harrowing budget fights in Congress.

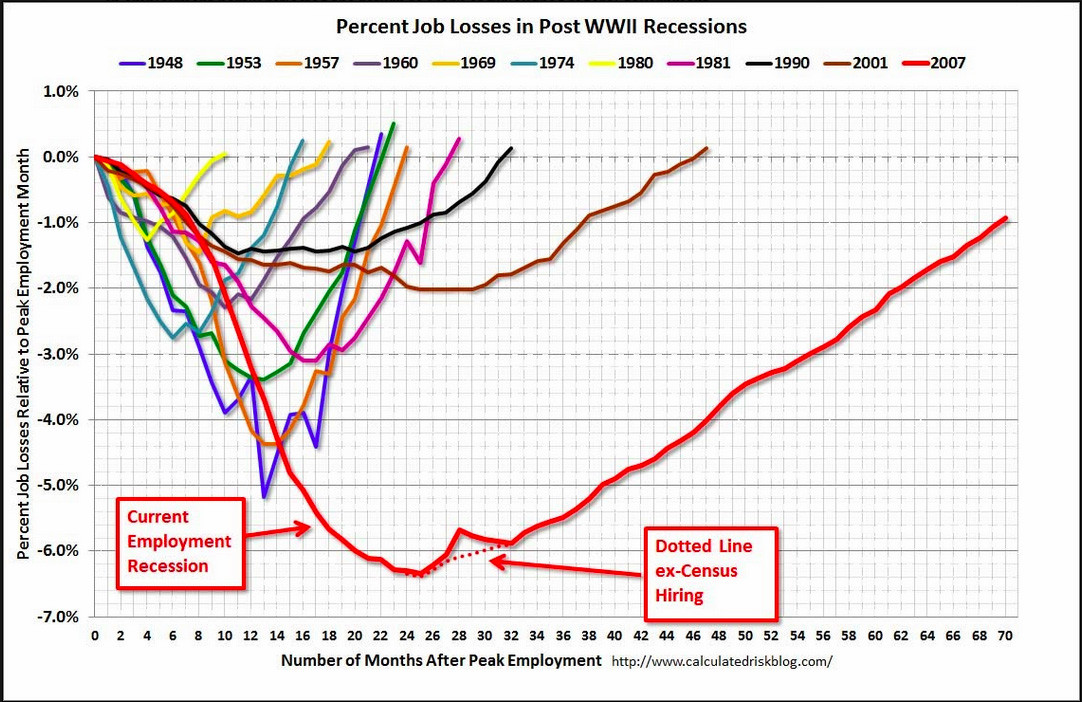

All of these headaches have conspired to make this the slowest job-market recovery since World War II, as this chart from Bill McBride of the Calculated Risk blog shows: