Congress should create new classifications for both federal and private student loans, and open them up for discharge in bankruptcy, the Center for American Progress has argued in a report released Tuesday.

Under existing law, student loans are practically impossible to discharge in bankruptcy, but a new report from the Center for American Progress, a liberal think tank in Washington, D.C., explained a way to change that and potentially to create more transparency for borrowers.

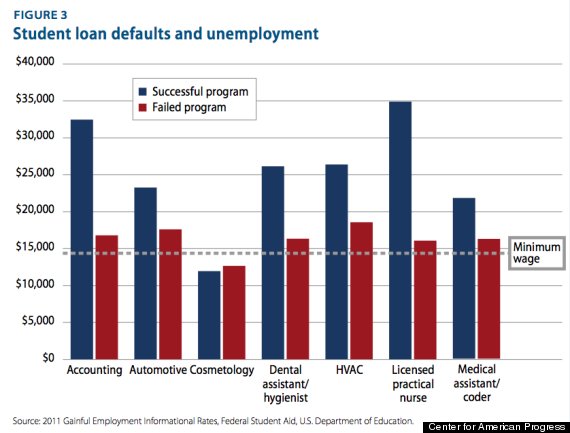

The report calls for the classification of "Qualified Student Loans," essentially loans that would remain protected from bankruptcy but would offer reasonable repayment terms for students in college programs with positive employment outcomes.

Under CAP's proposal, a Qualified Student Loan would have to have interest rates that do not exceed caps established by Congress, would offer deferment and forbearance provisions, and would allow for income-based repayment. In addition, the institution at which the borrower enrolls would have to meet minimum standards for completion (i.e., graduation rates), job placement and evidence-based future salary projections.

Non-qualified student loans in CAP's model -- like those with unaffordable repayment plans for students who enroll in ineligible education programs -- could be discharged in Chapter 7 bankruptcy after a specified waiting period.

"We know there is an increasing share of our adult population that has student loans, and that's a trend that will continue for a foreseeable future," said David Bergeron, co-author of the report and vice president for postsecondary education at CAP. "Some number of those will find themselves in the unfortunate circumstance in having taken out a loan with a excessively high interest rate and face the possibility of wage garnishment."

Another added benefit, CAP's report suggests, is that the Qualified Student Loan model would push higher education institutions to improve their academic programs and ensure their graduates are getting real jobs in the fields they study.

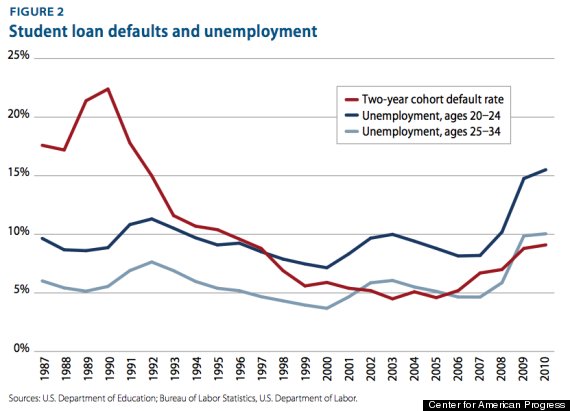

CAP's report notes that as the share of college students taking out student loans continues to rise, the share of borrowers in default has also increased in recent years in correlation with rising unemployment rates.

Currently, more than 7 million borrowers are in default on federal or private student loans, according to the Consumer Financial Protection Bureau. Only 4 in 10 federal loan borrowers are currently paying back their debt, with many others either still in school, in a six-month grace period, or in programs designed to help distressed borrowers.

"We also need to keep in mind with the student borrower, there is the parent borrower or grandparent borrower," said Joe Valenti, the report's other co-author and director of asset building at CAP. "There is a surprising number of older Americans who have this debt."

Indeed, parents over 60 are the fastest growing debtors, borrowing either to pay for their own education or to help finance their family's college expenses. But having these borrowers default could lead to garnishing part of their Social Security benefits.

The CFPB has warned that the increasing student loan burden could dampen the entire economy by restricting borrowers from purchasing a home or other items due to budgetary constraints.

The CFPB has suggested Congress review the laws restricting private student loan borrowers from discharging their debt in bankruptcy, and some lawmakers have introduced bills to make such a change. However, CAP's bankruptcy proposal would also include federal loans, as the report notes that Parent PLUS loans don't offer protections like income-based repayment plans.

"Ultimately this is something where Congress will have to act," said Bergeron, formerly the acting assistant secretary for postsecondary education and deputy assistant secretary for postsecondary policy, planning and innovation at the U.S. Department of Education. Bergerson said this reform is unlikely to be something the Obama administration could implement on its own.