Many businesses applying for loans are looking to finance receivables and other working capital, according to a new survey of bankers by Sageworks, a financial information company.

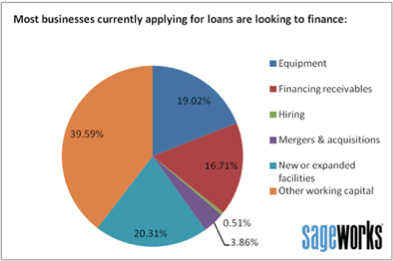

Nearly 17 percent of banking professionals surveyed said most businesses are seeking loans to free capital tied up in receivables, while another 40 percent said most loan applicants are looking to borrow for other working capital needs. Working capital is used to fund day-to-day operations at companies, so in addition to receivables, it could cover expenses such as payroll and the costs of procuring, storing and managing inventory.

Nineteen percent of the surveyed bankers, who work closely with businesses, said loans were targeted for equipment, and 20 percent said loans are being sought for new or expanded facilities.

It's unclear from the survey why such a large percentage of borrowers may be seeking working capital financing. But one factor at play could be the record-low interest rates, said Sageworks analyst Regan Camp.

"With interest rates as low as they are, companies could be borrowing money to buy inventory or acquire competitors, because if they can fund these things by increasing their working capital levels at a next-to-nothing cost, why wouldn't they?" Camp said.

It's also possible that companies are seeking financing because they're having a harder time meeting their short-term obligations, but Camp said that doesn't seem likely, considering Sageworks' data on the sales growth, profitability and creditworthiness of privately held companies.

Private U.S. companies have generated an average sales growth of 9.7 percent in the period ended February 2013, close to the growth rate a year earlier, according to data from Sageworks' latest Private Company Report. They have an average net profit margin of 7.6 percent, which is improved from 4.6 percent a year earlier.

Private-company credit risk has also improved. Private companies' debt relative to EBITDA, on average, is lower than a year ago, the report said. And a more comprehensive measure of creditworthiness, probability of default, has improved to an estimated 3.2 percent from 4.6 percent a year ago. The probability of default is the likelihood that a company will be unable to meet its financial obligations over the next 12 months. A default could include a borrower being 90 days past due on a loan, a loan being placed in a nonaccrual status, a write-down on the obligation, a troubled-debt restructuring, or a bankruptcy.

Given all of that, Camp said, it could be that companies that have gotten and stayed lean over the last several years now have a more optimistic outlook.

"Interest rates are so low, companies may now see that as an opportunity to get additional working capital to enhance their processes or to increase their levels of productivity," he said. "If I'm a construction company, I might seek working capital financing first, if I need it, or second, if I see an opportunity to get money cheap so that instead of building two houses I'm building 10. Why tie up the capital I've already recognized from the sales in [accounts receivables] or raw materials when I can basically borrow money for next to nothing and I can keep my own capital."

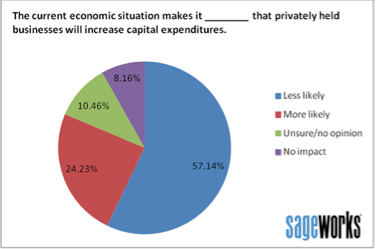

On the other hand, Camp noted that another question in the Sageworks survey indicated privately held businesses may not be enthusiastic about major spending. Fifty-seven percent of banking professionals surveyed believe the current economic situation makes it less likely their clients will increase their capital expenditures, compared with 24 percent who said the economy made it more likely. Ten percent were unsure and 8 percent said the economic climate had no impact on capital spending plans.

"People may be more reluctant to increase capital expenditures based on the uncertain economic landscape, but at the same time, people are trying to recover, and sometimes that requires spending to grow," he said. "The value of liquidity is high, so if you can get additional liquidity at the low interest rates, now's a good time to do it."

Sageworks conducted the online survey between March 8, 2013, and March 31, 2013, collecting responses from 392 banking professionals. The poll's respondents were all clients of Sageworks and were not randomly selected.