By Jim Finkelstein with Tom Brown

When Hostess Brands announced on November 21, 2012 they were unable to reach a settlement with the Bakery, Confectionery, Tobacco and Grain Millers Union (BCTGM) and were liquidating the company, Twinkie aficionados world-wide mourned. Critics thought that Hostess Brands, consistent with its famous Twinkies, would never spoil. Unfortunately, they were wrong. Or were they? On February 28, the bankruptcy judge approved the sale of Hostess' bread line for approximately $360 million. Other brands are scheduled for auction in mid-March. Maybe there is life for Twinkies.

Individual Entitlement vs. Corporate Sustainability

The Hostess meltdown provides the perfect environment in which to talk about the yin and the yang within the ranks of corporate citizenry. In any business organization, there exists a sense of entitlement on the part of executive leadership and employees. Executives and employees alike are looking for more - salaries, benefits and other perquisites. Who has control and who gets the greater payout represents a major difference between these two stakeholders. This inherent tension must be weighed against the overall success of the organization, as measured by the owners of the business.

Let's put some context around the Hostess derailment. Its operations and financial performance was dismal. Ingredient, distribution and other operating costs were on the rise. The company was losing money. Fixed assets were outdated. Cash flow was tight. Hostess was a classic turnaround situation. Yet, when we step back and sift through the finger pointing and allegations, the negotiations, and court filings, compensation and benefits was the larger issue, and both executives and employees were to blame.

What was the employee arrangement? Per the company's bankruptcy filings, the company employed over 18,000 people, represented by 12 different unions, subject to 372 different collective bargaining agreements. There were 42 different pension plans and 80 different health and welfare plans. Wow! Atlas didn't carry this much weight. To make matters worse, the plans were significantly underfunded at the time of the bankruptcy filing, contributing to the troubled plans and drag on corporate cash flow.

It's Not Whether You Win or Lose, It's How You Place the Blame

There are always two sides to every story.

On one hand, it's easy for executives to claim employees were the cause of the company's destruction. They make this claim on the Hostess Brands website. "... Hostess Brands has been forced by a Bakers Union strike to shut down all operations and sell all company assets."

The absurdity of this claim is self-evident. Neither company executives nor the bankruptcy judge were under duress when they made the decision to liquidate the company. The union strike was not the one single event that brought the company to its knees. Hostess should have been reorganized years ago. Yet, there is some truth to the statement that employees were partially responsible for the deterioration of the Company and their ability to continue operating profitably.

From the employee perspective, executives were highly compensated despite the continued poor performance of the company. It is alleged that prior to the second bankruptcy, Hostess executives received salary and benefit increases of 80%, although this allegation has not been substantiated. However, given company performance, critics remain skeptical that the board approved such generous raises, and would have been remiss in their fiduciary responsibility. Moreover, the optics of such a move is negative, because the overall compensation structure of an organization is set by top management and the board of directors. Still, union members would see any increases in executive compensation as a sign that they should ask for more money, perpetuating the cycle of entitlement. It's the black hole of organizational culture - spinning faster and faster out of control until the organization disappears. Fortunately, the interim CEO took control and reduced executive salaries to $1 annually, intending to return the organization to stability.

The Breakdown of Trust

The fundamental issue driving employee behavior at all levels is that everyone wants more. All employees, without regard for the long-term financial and cultural impact to the company, want to maximize income and benefits. There is no standard employee guideline for benefits - some want salary, others medical benefits, while still others want long-term or deferred incentives.

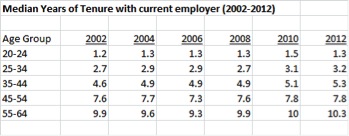

How did we get here? There has been a breakdown of trust between owners and employees. Employee loyalty to companies has shifted, where working for 30 years and retiring with a reasonable pension and perhaps health benefits is no longer the norm. As shown in Table 1, according to the Bureau of Labor Statistics, the median years of tenure with the current employer has been rising across all age groups, yet is dramatically low, particularly with younger workers. This may be the result of the Great Recession of 2008 and the stagnant growth rate since. Migration from job-to-job over short periods reduces the trust employers have in employees, who are again looking to maximize their benefits. Unions represent a slightly different pattern, as they may move between jobs, yet are protected under the umbrella of a union contract.

Table 1. Median Tenure (Source: Bureau of Labor Statistics)

Win-Win: the Optimal Outcome

Hostess provides a prime example of how individual avarice and contract precedent can work against the greater corporate objectives of sustainability, growth and profitability. Men and women lost their jobs, plants were closed, products were discontinued and a group of attorneys and accountants made a lot of money. Alternatively, the two groups could have engaged in a conversation to simplify and restructure the company such that Hostess remained a viable entity and employees were heard and taken care of. Win-lose, or in this case lose-lose becomes win-win. This is, after all, the optimal outcome in any negotiation.

In the end, Hostess employee's pensions will be covered by the PBGC or paid out of Hostess brand sales proceeds. With any luck, former employees will return to work, and the cycle will begin again. Hopefully, the acquiring company's leadership understands yin and yang and will engage with all employees to work to develop a profitable organization that sets reasonable expectations for compensation and benefits at all levels.

If not, the Twinkie could be headed for permanent spoilage.

*************************

Jim Finkelstein is the Founder, President and CEO of FutureSense, Inc. a management consulting firm specializing in people and organization effectiveness. He continues to believe that businesses and organizations need to think 'off of the edge of the paper' in order to assure themselves of the most favorable solutions and outcomes. Jim also believe that determining the unique right practices for each situation is preferred to "flocking like sheep to the slaughter" by following perceived best practices. What works for one organization may not work for another!

Tom Brown is a Senior Consultant with FutureSense, Inc. He is devoted to creating change. Tom believes change comes from inspiring people, creating new models and ways of thinking and looking for and leveraging each individual's strengths. As Einstein once said, "The world as we have created it is a process of our thinking. It cannot be changed without changing our thinking."

About Jim Finkelstein - www.linkedin.com/in/jimfinkelstein

About Tom Brown - www.linkedin.com/pub/thomas-brown/0/506/61a