The global crisis has pushed trade reforms off -- or at least to the edge of -- the political radar screen. But shying away from improving the trade system in these tough economic times seems a little like cutting off your nose to spite your face.

The IMF's First Deputy Managing Director David Lipton summed the issue up in a recent speech: "trade wars can put millions of jobs in jeopardy, while trade integration can be an engine of growth."

Rising pressures

As the crisis has become protracted and unemployment remains stubbornly high in many economies, there are worrying signs that protectionist pressures may be on the rise. There are plenty of examples: recent actions by Brazil at the World Trade Organization (WTO) aim to use trade remedies to offset currency misalignments, China imposed duties on cars made in the United States, and legislation is pending in the United States to use trade measures to defend against "undervalued" currencies such as the renminbi.

But now is certainly not the moment we should be putting jobs and growth to the test.

Fortunately fears of a widespread resurgence of 1930's-style trade protectionism after the 2008 financial crisis proved unfounded. This was thanks, in large part, to a shared responsibility by countries and institutions for the multilateral trading system.

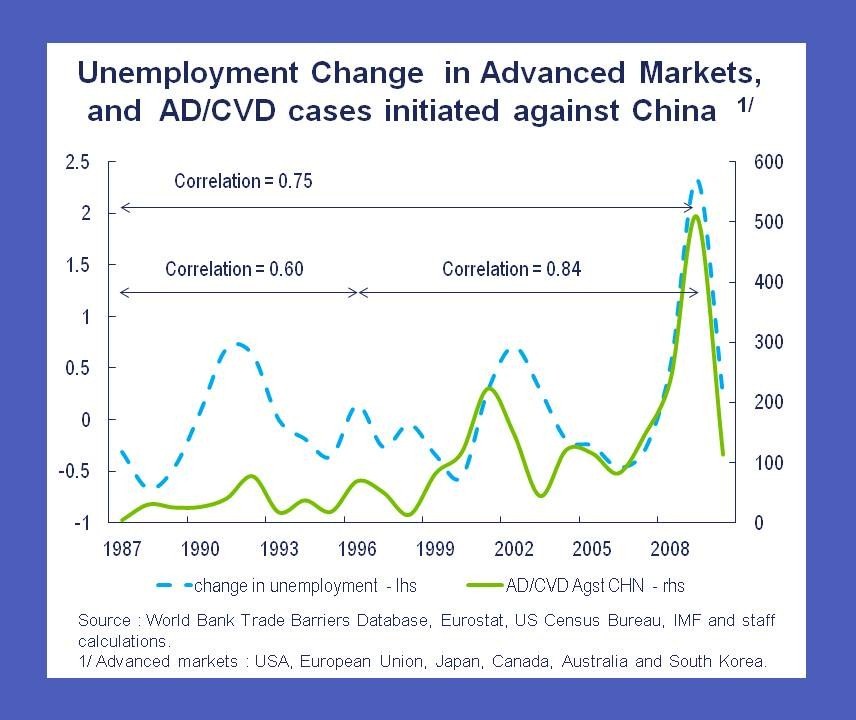

Yet, our analysis reveals that advanced economies experiencing the largest increases in unemployment were also those most inclined to impose trade restrictions--as suggested by the number of cases of anti-dumping and countervailing duties initiated against China. In fact, we saw a big uptick in these measures in recent years (see chart).

Macroeconomic barometer

The Fund may not be the main player on the trade 'block', but we certainly take an interest given its macroeconomic importance.

In fact, prospects for the global recovery and impending risks to the multilateral trading system were foremost in our minds when, together with the World Bank and WTO, we held a trade conference--the first such event--in December 2011.

Fund staff presented two papers at the conference.

Changing Patterns of Global Trade examined the growing role of vertical integration through global supply chains. It highlights the importance of value-added analysis (as opposed to gross exports) in examining trade inter-linkages and implications for the response of trade flows to exchange rate changes.

Protectionist Responses to the Crisis: Damage Observed in Product-Level Trade found evidence that, while there was no widespread protectionist action and only a limited generalized impact on trade, protectionist measures did have a strong impact on trade in the particular products to which they were applied.

This brings me back to David Lipton's point--now is the time to resist protectionist pressures and re-energize the process of trade integration. Trade should be able to contribute to, and not detract from, a global recovery.

Which way the wind blows

On this score, reaching agreement on the Doha Development Agenda--the broad deal launched in November 2001 to facilitate development through trade--remains important, and we need to explore fresh approaches to conclude it.

But the multilateral trade agenda needs to go beyond Doha and focus on new emerging issues, such as open regionalism and food and energy security. Without multilateral attention, these issues risk giving rise to unilateral "trade remedies" and deals among smaller groups.

- In October 2011, the United States ratified three bilateral free trade agreements with Columbia, Panama, and South Korea.

- In November, nine Asia-Pacific countries embraced a groundbreaking regional trade liberalization deal known as the Trans-Pacific Partnership (TPP). Japan's commitment to join the TPP talks is particularly important, marking a potentially historic milestone in opening up sensitive sectors. And, with the world's third largest economy, the TPP would be the largest free trade zone, representing close to 40 percent of the world economy.

- In light of recent deleveraging by European banks, we launched in December an ad-hoc trade finance survey, in collaboration with the International Chamber of Commerce. The results will help us monitor risks to global trade credit and provide timely input into ongoing discussions by the Group of Twenty advanced and emerging market economies.

- Global supply chains will be an ongoing area of work, looking more in depth at value-added trade flows and the implications for trade interconnectedness and exchange rate assessments.

- Last, but not least, we are also developing a new index of protectionist pressure. The goal will be to summarize the key macroeconomic variables--such as growth rates, unemployment, imports, and exchange rate regimes--that help foreshadow protectionism. The index would be amenable to regular updates in line with revisions to the IMF's global projections, and could thus serve as the Fund's own gauge on trade winds.